Featured image credit: Edward De la Torre

The 1031 exchange is so frequently used by savvy investors of commercial real estate that you’ve likely heard of it before. 1031 exchanges remind me of that famous scene from Raiders of the Lost Ark. You know, the part where Indiana Jones replaces the golden idol with an equally heavy stone to prevent the trap from springing? Well, a 1031 exchange requires you to replace one of your investment properties with a similar property. But in this case, the trap you’re trying to prevent is a hefty capital gains tax. Let’s take a closer look at one of the most useful tools in a knowledgeable investor’s repertoire.

What is a 1031 Exchange?

A 1031 exchange allows you to swap out one of your investment properties for another “like kind” property. This means selling the original or relinquished property to purchase a similar property. Because of this, 1031 exchanges are also colloquially referred to as “like kind exchanges.”

So, what constitutes a “like kind” property? Surprisingly, it’s not a very strict criteria. If you own an apartment building, you can usually swap out for another apartment building, regardless of number of units. However, if you attempt to exchange a 30-unit complex in Los Angeles for a 30-unit building in Dubai, you’re very likely to run into problems. You can even swap out for a property from a different asset class, as long as it’s still for investment purposes.

But where does the number 1031 come into the equation? When consulting the IRS code, you’ll find 1031 exchanges explained under section 1031.

1031 exchanges are popularly used in commercial real estate as a means of deferring capital gains taxes. By doing so, investors can lower their overall capital and more quickly build equity, freeing them from lender support.

Requirements You Must Meet to Use a 1031 Exchange

In order to use a 1031 exchange, your transaction must satisfy a series of requirements including:

- A purchase of a like-kind property must be made for the express purpose of investment.

- The purchased property must be of equal or greater value than the relinquished property.

- All proceeds from the sale of the relinquished property must go specifically toward investment in the purchased property.

- The title holder and taxpayer must be the same.

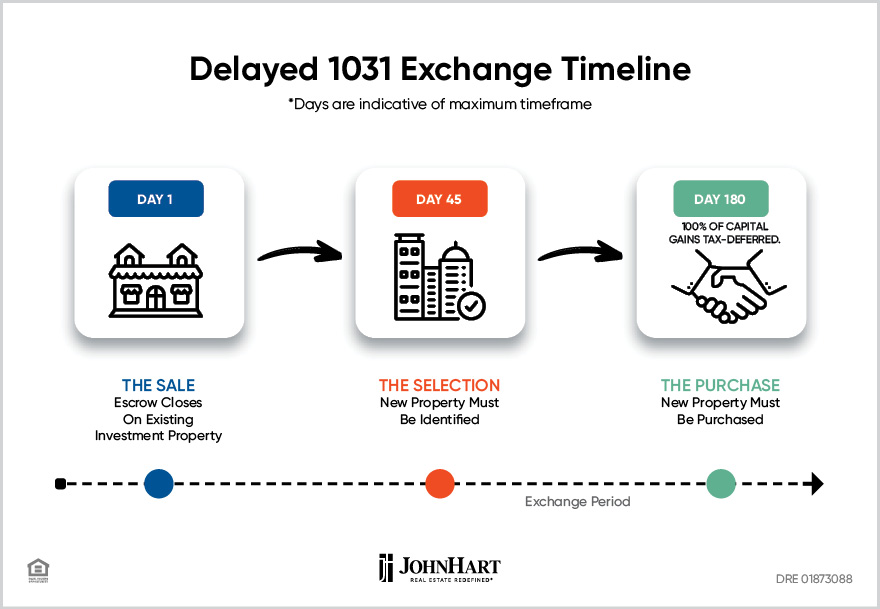

- The purchased property must be identified within 45 days of the sale of the relinquished property.

- The purchased property must be purchased within 180 days of the sale of the relinquished property.

Timing Your 1031 Exchange Just Right

When it comes to effectively executing a 1031 exchange, timing matters… a lot. With this factor in mind, 1031 exchanges have been broken down into four basic categories.

Delayed Exchange

A delayed exchange is the most common 1031 exchange type. In this type of exchange, an original investment property is sold in favor of purchasing another like-type investment property at a later date. The new property must be identified no later than 45 days following the sale of the original property. Likewise, purchase of the replacement property must close no later than 180 days following the sale of the initial property. Expect the proceeds from the sale to be held in a trust during the interim.

Simultaneous Exchange

As you may have guessed, a simultaneous exchange describes that somewhat rare exchange when you sell your relinquished property on the same exact day as you purchase your replacement property. Everything needs to go off without a hitch. Even the lightest snag could delay the purchase or sale, leaving you wide open for capital gains taxes.

Reverse Exchange

In a reverse exchange, the replacement property is actually purchased prior to the sale of the property you’re relinquishing. This can be beneficial if you want to take your time with a sale in the hopes that its market value increases.

Construction/Improvement Exchange

This type of exchange allows you to use proceeds from the sale of your original investment property to make repairs to the property you’re purchasing. During the interim 180 day period, the property will be held by a qualified intermediary. However, to remain free from capital gains taxes, an improvement exchange must meet the following criteria:

- All exchange equity will need to be put directly into the replacement property.

- The changes can’t be too major because the taxpayer will need to receive the same property that was identified on the 45th day following the sale of the initial property.

- When the property is returned to the taxpayer, it will need to reflect an equal or greater value than its original value at the beginning of the exchange.

- All planned improvements must be made within the 180 day window.

Using a 1031 Exchange As a Means of Deferring Capital Gains Taxes

The biggest reason investors go through the, at times, white knuckle ride of a 1031 exchange is to defer capital gains taxes. Usually, when you sell an investment property that you’ve owned for at least a year, you will be required to pay capital gains taxes. This tax applies to the difference between the sales price and adjusted purchase price of a property which also accounts for any renovations and repairs but removes depreciation.

Capital gains taxes can really add up, though this heavily depends on your tax bracket. But by using 1031 exchanges effectively, you could feasibly keep kicking that can up the road in perpetuity! Artful use of a 1031 exchange can also grant investors mobility to explore new asset classes without suffering a painful tax sting.

How 1031 Exchanges and Property Depreciation Interact

Many investors struggle to understand how 1031 exchanges can impact depreciation. In many cases, there won’t be any impact to depreciation at all. That’s because you’re ideally exchanging one property for another similar property. But in situations where the replacement property costs more than the original property, things get a little trickier.

Finding the Taxable Amount for Transactions That Don’t Use 1031 Exchanges

Let’s run an example to get a clearer idea. Say you purchased an investment property for $3 million. You hold that property for five years before you decide to sell that same property for $5 million. Five years would tally up an approximate depreciation figure of approximately $400,000. Not exact, but we’re trying to keep it simple.

We would then add the purchase price ($3 million) to the accumulated depreciation ($400,000) to get an adjusted cost basis of $3,400,000. At this point, you would need to add the depreciation figure ($400,000) to the sales price gain ($5 million minus $3 million equals $2 million). So, $400,000 plus $2 million equals $2,400,000. This is the taxable amount for transactions that don’t employ a 1031 exchange.

Finding the Total Cost Basis for Your New Investment

Now, let’s say you decide to purchase a new investment property for $6 million. In this situation, it is imperative that the new cost basis of investment from the original property apply to the new purchase. Therefore, the cost basis of your new investment property will be the adjusted cost basis from the initial property ($3,400,000) plus the price increase over the sold property ($1 million) for a total cost basis of $4,400,000 for the new property.

Two Methods of Dealing with Depreciation

At this point, you’re looking at two methods of dealing with the depreciation of your investments:

Single Schedule Depreciation

Hands down the most popularly employed method of handling depreciation, Single Schedule Depreciation is simple, but not usually the most lucrative choice. You’d simply take the new adjusted cost basis and divide it by 27.5 years for residential or 39 years for commercial properties to determine your property’s annual depreciation.

Two Schedule Depreciation

The road less traveled is often worth it in this case. You can look forward to a decent financial boost by employing Two Schedule Depreciation, but it’s a much more involved process than Single Schedule Depreciation.

Calculating Your Equity

In order to confidently use 1031 exchanges to your advantage, you’ll also need to have a keen awareness of your equity. When it comes to real estate, equity marks the difference between the amount that you still owe on your property and its current market value. But equity isn’t just about informing your investment strategies. The higher your equity, the more autonomy you’ll have to purchase additional investment properties.

So, how do you calculate your equity if you don’t already know it? Start out by subtracting your property’s closing costs from your gross selling price. Then subtract the debt that you still owe for the property from this figure. You’re left with your investment property’s equity.

Your Next Step

I’ve given you a lot of information about 1031 exchanges to absorb. Believe it or not, this is only scratching the surface. However, it may have inspired you to begin thinking about how you can use a 1031 exchange to further your own investment goals. If you’d like to discuss 1031 exchanges more in-depth, I’d love to take a look at your specific scenario and lend my insight. Reach out and let’s talk today!